haven't filed taxes in 10 years canada reddit

If you go to genutax httpsgenutaxca you can file previous years tax returns. Before May 17th 2022 you will receive tax refunds for the years 2018 2019 2020 and 2021 if you are entitled to them.

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

Before May 17th 2022 you will receive tax refunds for the years 2018 2019 2020 and 2021 if you are entitled to them.

. What happens if you havent filed taxes in 10 years in Canada. If youre overwhelmed with your taxes they might be able to support you with any tax issues as you file. If You Dont File Your Return the IRS May File a Return for You.

If you havent filed in years and the CRA has not yet contacted you about your late taxes apply to the Voluntary Disclosure. Havent filed personal or small business T1 corporate income tax T2 or GSTHST returns in several years or more. The longer you go without filing taxes the higher the penalties and potential prison.

Havent filed taxes in 10 years canada. According to the CRA a taxpayer has 10 years from the end of a calendar year to file an income tax return. Further the CRA does not go back greater than 7 years.

Filing taxes late in canada. If you earned this money while out of the country for greater than 2 years you are not required to file a return on it. This is called a substitute for return SFR.

4000 fine for failing to file personal and corporate tax returns. What happens if you havent filed taxes in 10 years canada Tuesday May 24 2022 Edit If you fail to file on time again within a three-year period that penalty goes up to 10 of. Contact a tax professional.

After April 15 2022 you will lose the 2016 refund as the statute of. See if youre getting refunds. After May 17th you will lose the 2018.

Start with the 2018 one and then go back to 2009 and work your way back. The CRA will let you know if you owe any money in penalties. Before April 15 2022 you will receive tax refunds for the years 2018 2019 2020 and 2021 if you are entitled to them.

If you havent filed tax returns the IRS may file for you. Its too late to claim your refund for returns due more than. Get all your T-slips and what ever.

According to the CRA a taxpayer has 10 years from the end of a calendar year to file an income tax return. If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance owing for.

10 Red Flags That Could Trigger An Irs Tax Audit In 2022 Wsj

Irs Tries To Reassure Pandemic Panicked Taxpayers

Report Interest Income To Irs Even If It S Just 50 Cents

What Happens If Taxes Are Not Filed Canada 2021 Remolino Associates

Do Your Homework Before Paying To Get Your Taxes Done Cbc News

2 Million Canadians Who Haven T Yet Filed Taxes Could Face Benefits Interruption Cra Warns National Globalnews Ca

Best Sportsbooks On Reddit 2022 Reddit Sports Betting

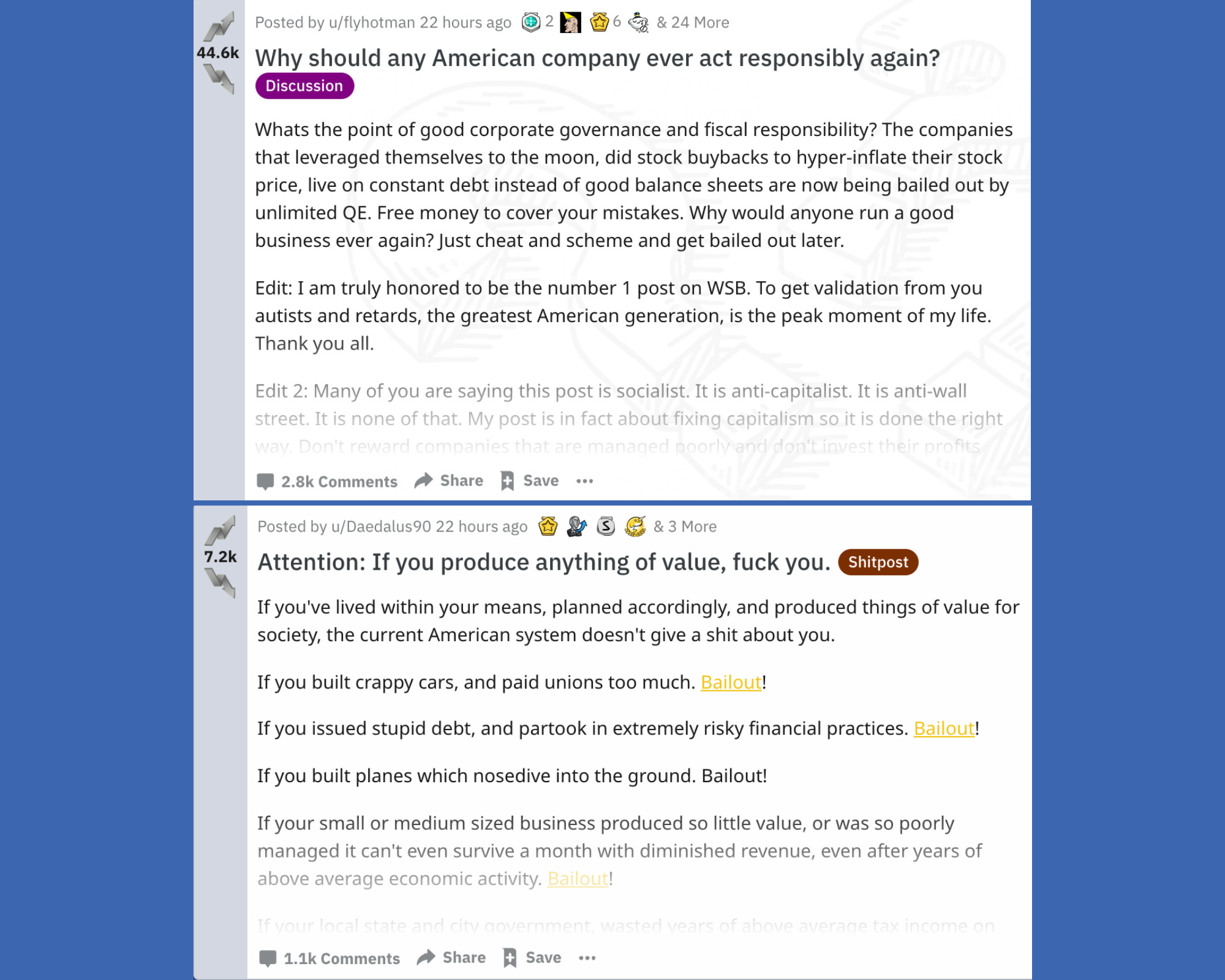

Why Meme Stock Traders Love The Doj S Criminal Probe Of Hedge Fund Short Sales Bloomberg

2 Million Canadians Who Haven T Yet Filed Taxes Could Face Benefits Interruption Cra Warns National Globalnews Ca

Best Sportsbooks On Reddit 2022 Reddit Sports Betting

Haven T Filed Taxes In 10 Years Don T Know Where To Start R Legaladvice

/cdn.vox-cdn.com/uploads/chorus_asset/file/22363424/210308_fciccolella_voxmedia_inheritance_secondaryillustration.jpg)

How Inheritance Became A Gift A Necessity And A Curse Vox

Some Taxpayers Say They Ve Already Received Their Tax Refund

Best Sportsbooks On Reddit 2022 Reddit Sports Betting

The Stockgeek Newsletter Travis Devitt Substack

![]()

Reddit Warrant Canary Disappears From Transparency Report Zdnet

Clubhouse App Emerging As Anti Reddit Forum For Stock Tips And Investing Advice Bloomberg

/cdn.vox-cdn.com/uploads/chorus_asset/file/23202312/acastro_220128_4980_0001.jpg)

Public Accountants Are Deducting Themselves From Their Jobs The Verge